The way society interacts with and views businesses has shifted in recent years. From a higher demand for corporate social responsibility to a desire for more workplace flexibility, here are some ways changing societal views are changing the risk landscape.

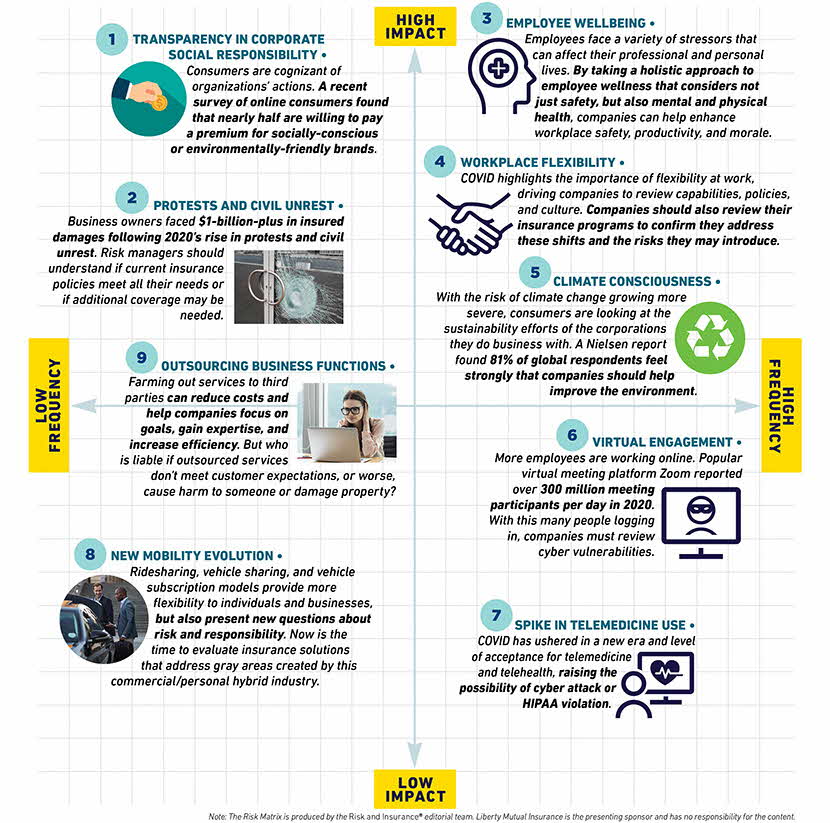

The Societal Shift Risk Matrix featuring 9 ways societal views are altering risk for businesses.

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots nine evolving risks and challenges that businesses may face because of society’s changing views, based on frequency and severity.

Transparency in corporate social responsibility

As social, environmental, and political issues continue to dominate headlines, many investors and customers are taking the same lens when examining the business landscape. Unlike a company’s philanthropic efforts, a company’s corporate social responsibility (CSR) is a bellwether of a company’s social and environmental values. The impact of social inflation in the courts has shown that people care about what businesses are up to, and CSR is a part of that equation. Actions toward sustainability, climate engagement, and diversity and inclusion efforts can go a long way with stakeholders.

Protests and civil unrest

The year 2020 brought to light in a whole new way the impact of civil unrest and protests on insurer and insured alike. Following last year’s protests and civil unrest, business owners noted a $1-billion-plus bill in insured losses nationwide. Reviewing property policies is a must for insureds as we move forward. An additional tool in the risk mitigation toolbox could be the addition of a war and terrorism policy, which can cover events that may be excluded from property coverage or not meet TRIPRA (Terrorism Risk Insurance Program Reauthorization Act) conditions.

Employee well-being

As a result of the pandemic, employees have faced a variety of stressors that can affect their professional and personal lives. By taking a holistic approach to employee wellness that considers safety as well as mental and physical health, companies can help enhance workplace safety, productivity, and morale. Consider questions such as: is there an adequate supply of personal protective equipment? Do employees feel safe upon re-entering office buildings and other workstations? Employers should communicate available information and resources, such as employee assistance programs, to help support employees.

Workplace flexibility

Culture isn’t something that you can manufacture; it must be developed over time with the company’s employees, customers, and goals in mind. A company’s culture, especially in times of change, is essential. It provides workers with the structure and understanding that their company will not only do right by them but also by their customers and clients. During the pandemic, technology has played a vital role in company outreach, showcasing workplace flexibility and understanding in times of uncertainty.

Climate consciousness

Climate change affects businesses of all kinds across the globe. In 2020, businesses saw $97 billion worth of global insurance losses. But beyond extensive property damage and lost revenue, companies are now facing an increase in litigation, workers compensation implications, and rising auto repair costs. Consumers in markets big and small are increasingly motivated to be more environmentally conscious and expect the companies they support to do the same. A Nielsen report found 81 percent of global respondents feel strongly that companies should help improve the environment.

Outsourcing business functions

Looking to third parties for certain business functions can help a company reduce costs, meet demand, gain expertise, and hasten growth, but outsourcing can also usher in additional liability exposures. There are actions a risk manager can take to mitigate potential risks, including working with its legal department to evaluate contracts and set service standards, perform vendor risk assessments, review its safety policies, and confirm its insurance programs are adequate.

New mobility evolution

People are changing the way they travel. Rides are shared. Cars are shared. Even boats and RVs are shared. These ridesharing, vehicle sharing, and vehicle subscription new mobility models provide flexibility to individuals and businesses, but also present new questions about risk and responsibility as the lines between personal and commercial insurance blur. From coverage ambiguity to evolving regulations, there are several risk-management challenges businesses should consider as they enter into this fast-paced industry.

Virtual engagement

The remote workforce, for better or worse, is here to stay, and with it comes a very large uptick in virtual engagement across a variety of online meeting platforms. As companies continue moving away from the traditional work settings, now is the time to reassess and mitigate work-related risks for remote workers. This shift in business operations also presents new challenges, from tracking employee time to workplace safety and employment practices.

Spike in telemedicine use

While the pandemic has been credited with the rise in telemedicine use, many in the healthcare industry believe telehealth’s popularity will outlast COVID-19. This is due in part to the easy access such health services provide patients. But this also means hospitals and other healthcare facilities must review their vulnerabilities to address areas including cyber risks, provider credentialing, and more.

Featured insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.