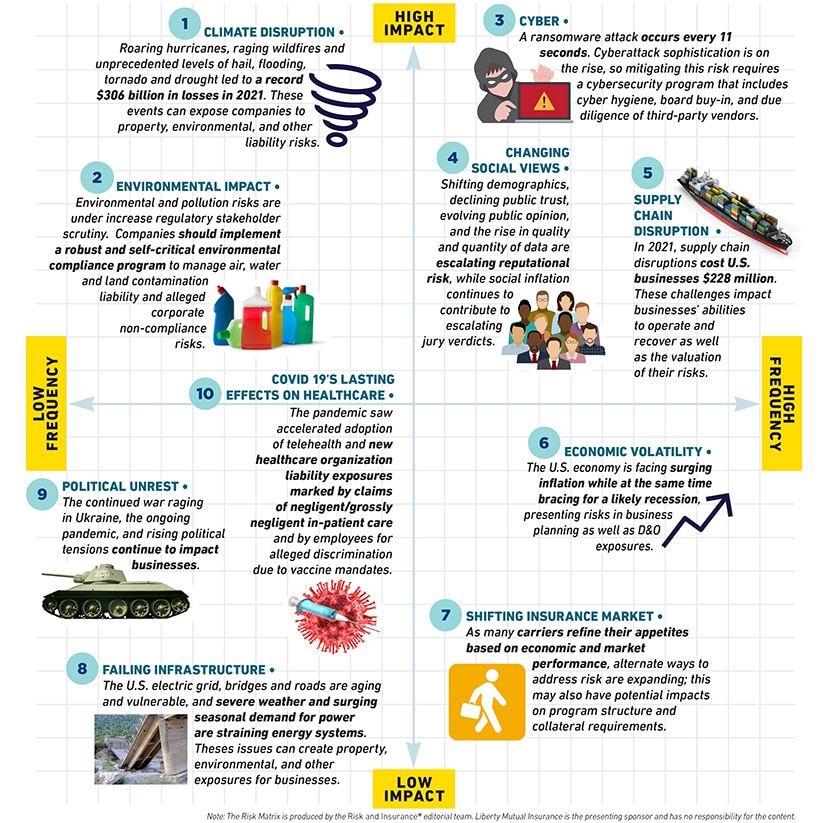

As the world emerges from the pandemic, its impacts are still being felt. From ongoing supply chain disruptions and rising political tensions to climate change and surging inflation, here are 10 ways today’s environment is accelerating specialty lines exposures for businesses.

The following Risk Matrix, produced by the editorial team at Risk & Insurance®, highlights the likely impact and frequency of 10 factors driving specialty risks.

Climate disruption

Though it’s been a quiet start, experts expect an above-average Atlantic hurricane season. Predicted drier, windier weather on the West coast will likely increase wildfire spread. When natural disasters strike, the immediate damage is often just the start. A single event can create property, environmental, and liability risks for businesses. There are steps business can take so they are not caught off guard by the downstream impact of storms and severe weather events.

Environmental impact

Environmental and pollution risks are under increased regulatory stakeholder scrutiny. Companies should look at their lasting impact on the environment, from increased PFAS liability to weather-related mold and storage-tank exposures. They should also implement robust and self-critical environmental compliance programs to manage air, water and land contamination liability and alleged corporate non-compliance risks. Carbon sequestration is one solution that may help limit potential emissions from some operations that currently have limited to no other pathway toward decarbonization.

Cyber

With ransomware attacks nearly doubling last year and cybercrime predicted to cost the world $7 trillion USD in 2022, no business is safe from the operational and financial impacts of cyberthreats. To mitigate this risk, companies should maintain cybersecurity programs that include making the board aware and involved in the cyber resiliency response, reviewing cyber controls, training employees on phishing and other scams, backing up sensitive data, and conducting proper due diligence on third-party vendors.

Changing social views

Employees, consumers, and investors continue to place heightened responsibility on corporations to reflect authentic commitments to environmental, social, and governance (ESG) policies in their business operations.

If businesses make promises they don’t keep, the consequences can be steep – both in the court of public opinion and in the actual jury box as social inflation continues to contribute to escalating verdicts. To be effective and mitigate potential risks, business leaders should implement ESG programs consistently across their organizations. Having board involvement; taking a close look at vendors, suppliers, and other partners; and reviewing internal hiring and work practices are also critical areas to address.

Supply chain disruption

In 2021, supply chain disruptions cost businesses worldwide an average of $184 million annually, an estimated $228 million in the United States. Supply chain challenges, from quality challenges and rising energy prices to shipping delays, continue to impact companies’ financial performance. Added to that, the current labor shortage caused by the pandemic is affecting almost all industries, compounding the disruptions the supply chain faces. These factors impact a business’ ability to operate and the valuation of its risk.

Economic volatility

The U.S. economy is facing surging inflation, which is straining many companies’ business models and presenting challenges in forecasting financials. Additionally, the economy is bracing for a likely recession, presenting risks in business planning as well as directors and officers exposures.

Shifting insurance market

Today’s risk environment is unlike anything many businesses and insurance carriers have ever seen before. In response, many carriers are refining their appetites based on economic and market performance. In addition, alternative ways to address risk — such as wholesale market solutions, programs, and captives — are coming to the forefront.

Failing infrastructure

The U.S. electric grid, bridges, and roads are aging and vulnerable, with an estimated $2.6 trillion needed to address U.S. infrastructure weaknesses. Though the idea of building the resilient city is gaining traction, surging seasonal demand for power continues to strain energy systems. With power grids growing more likely to experience system-scale failure, it’s critical for organizations to consider the impact of prolonged power loss on their business.

Political unrest

The continued war raging in Ukraine, the ongoing pandemic, and rising political tensions continue to impact businesses. Any company, anywhere, and at any time can be affected by terrorism, strike, riot, or civil commotion. And while some events may be covered under the Terrorism Risk Insurance Program Reauthorization Act, others may not. Now is the time for businesses to review the benefits of a standalone war and terrorism insurance policy.

COVID-19's lasting effects on healthcare

The pandemic’s influence lingers for the healthcare industry as it grapples with the rapid change brought on by COVID-19 protocols. Telehealth use has skyrocketed, which can increase the risk of misdiagnosis and cyber threats. Healthcare facilities also face new liability exposures related to claims of negligent/grossly negligent in-patient care and alleged employee discrimination due to vaccine mandates. In addition, the current labor shortage has created exposures around patient and employee safety.

Featured insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.