Across the U.S., severe weather events such as hurricanes and wildfires are becoming the norm. These weather events have a lasting impact on the communities and businesses they hit, with the potential risks going far beyond just property damage.

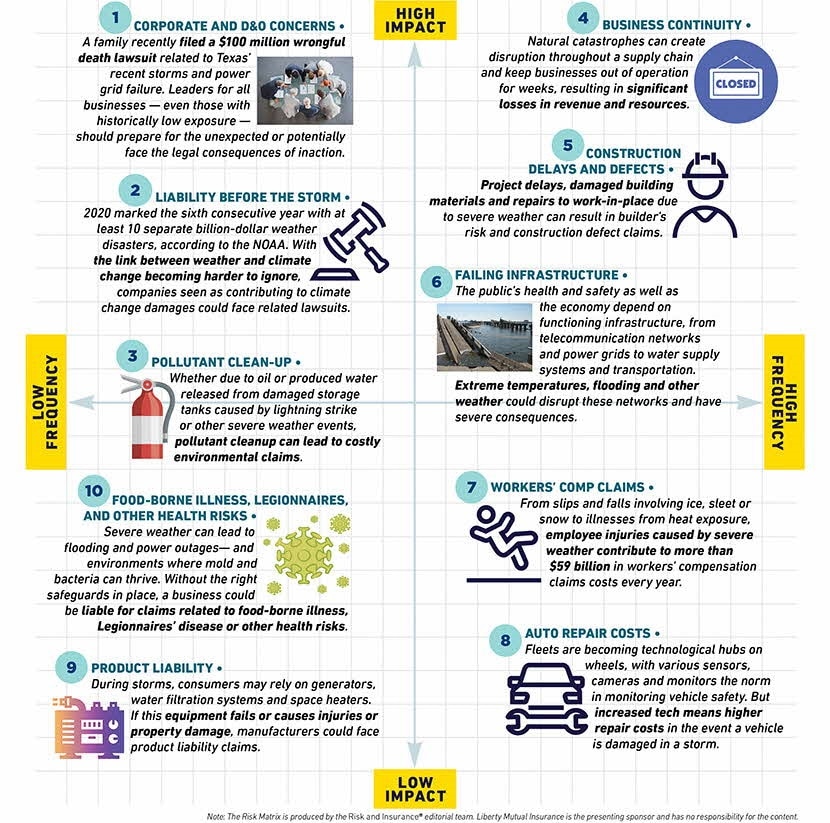

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots critical risks due to severe weather based on the frequency and severity of each risk.

Corporate and D&O concerns

Severe weather events often push systems to their limit. When those systems fail, businesses and municipalities may be liable for claims relating to property damage, business interruption, and even loss of life.

In Texas, for example, as Winter Storm Uri hit this past February, 5 million Texans were left without power in both their homes and businesses. Many were stuck at home. Others had to contend with burst pipes that couldn’t withstand the cold weather. Insurance might have covered immediate financial losses, but there are still long-term consequences and costs to consider, like any lawsuits arising from the incident. Business leaders need to prepare before a storm rolls in instead of waiting for its aftermath to act, lest they face accusations of putting profit above safety.

Liability before the storm

2020 marked the sixth consecutive year with at least 10 separate billion-dollar weather disasters, according to the NOAA. Predictions for 2021 show there’s no slowing down and the public is keeping an ever-watchful eye on how corporations respond before the storm. Are they focused on environmental, social, and governance (ESG) initiatives? Is sustainability part of their long-term plan when it comes to climate change? With the link between weather and climate becoming harder to ignore, and with increased public focus on sustainable practices, companies seen as contributing to climate change could face related lawsuits.

Pollutant cleanup

Lightning is the leading known cause of storage tank fires, which often leads to explosions and/or oil spills. Firefighters are battling fires with foam, releasing per- and polyfluoroalkyl substances (PFAS)—dubbed a “forever chemical”—into the ground. Cleanup costs for such pollutants are on the rise. PFAS, for example, can be upwards of $26 million to $73 million in cleanup costs for just one fire site. Environmental claims stemming from these incidents are becoming expensive, with some verdicts reaching into the millions of dollars.

Business continuity

Today’s global economy has made the world more interconnected than ever, but that also leaves operations at the mercy of global weather patterns. Natural catastrophes can create disruption throughout a supply chain and keep businesses out of operation for weeks, potentially resulting in significant losses in revenue and resources. No single plan works for every company, but there are crucial elements to creating a business continuity plan that can help a company prepare for, and bounce back from, disaster.

Construction delays and defects

Outdoor construction is directly impacted by weather. Any storm that leads to project delays or damaged building materials can lead to builder’s risk and construction defect claims. In fact, 75 percent of construction industry players reported experiencing a claim or dispute in the last five years. Luckily, building owners and general contractors can take action to help reduce the risk of such claims before they even arise, starting with reviewing scope of coverage and contractual protections and partnering with the right team to manage potential claims as they come in.

Failing infrastructure

Extreme temperatures, flooding, and other weather events are placing undue stress on existing infrastructure across the U.S. This can be detrimental for these networks and have severe consequences. This is a huge risk to the public’s health and safety, as well as the economy, because each depends on functioning infrastructure, from telecommunication networks and power grids to water supply systems and transportation.

Foodborne illnesses, Legionnaires’, and other health risks

Mold, legionella, and other bacteria grow in moist conditions, which are spiking due to humidity, volatile storms, and flood risk. For businesses, water systems are some of the most common areas for these diseases to thrive, making employee safety after a storm that much more critical to address. Review water management systems and put best practices into place.

Product liability

During storms, consumers may rely on generators, water filtration systems, and space heaters to accommodate any amenity disruptions. But in the event this equipment fails or causes injuries or property damage, manufacturers could face product liability claims. Regardless of why equipment is being sold, manufacturers should always evaluate the risk potential of their products and take precautions.

Workers comp claims

Wintry weather conditions contribute to roughly 20,520 workplace slip-and-fall injuries each year. Every year, thousands of workers become —and some cases are fatal. Such weather-related workers comp claims are estimated to cost more than $59 billion per year. Partnering closely with injured employees is vital to assisting them in their recovery and managing claims costs, with the primary goal of helping employees return as soon and safely as possible.

Auto repair costs

Fleets are becoming technological hubs on wheels, with various sensors, cameras, and telematics the norm in monitoring vehicle safety. But increased tech means higher repair costs in the event a vehicle is damaged in a storm. For example, the cost to replace a 2016 bumper—with its added sensors and technology— increased 130 percent compared to a 2014 bumper of the same model. Fleet operators should act now to manage commercial auto losses stemming from severe weather.

Related insights

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.