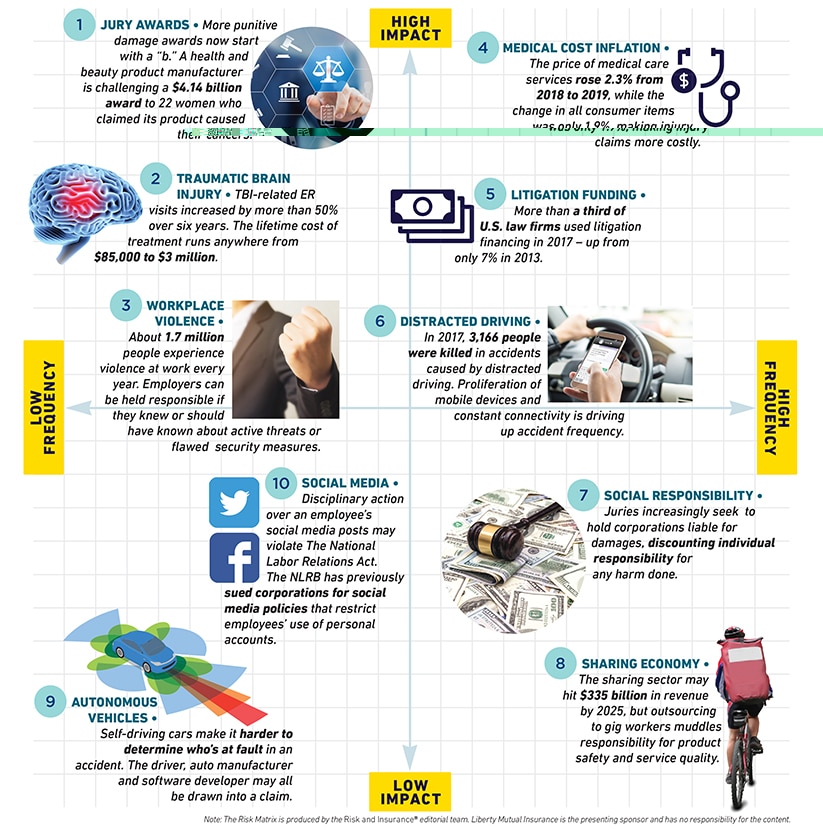

Several technological, legal, and social factors are driving up the frequency and severity of liability claims. From jury awards and litigation funding to autonomous vehicles, these and other trends are complicating liability exposures and forcing businesses to reassess their risk management strategies.

The Liability Risk Matrix featuring 10 critical risks

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots critical risks shaping the liability landscape based on the frequency and severity of each risk.

Jury awards

Jury awards are becoming more punitive in nature, with non-economic damages often exceeding property and injury damages. The rise in supersized verdicts may be partially due to the erosion of tort caps, which have historically limited the amount plaintiffs could seek in punitive damages. However, shifting juror sentiment and the growing use of litigation financing are also having an impact. These climbing verdicts more frequently pierce companies’ excess layers of liability coverage.

Traumatic brain injury

More than two million people seek treatment for traumatic brain injuries (TBIs) every year in the United States. There is a growing awareness of TBIs with high-profile concussion lawsuits bringing the symptoms and long-lasting effects to the forefront. As a result, more TBI claims are being asserted, sometimes in less serious accidents. MRIs and CAT scans can help identify internal damage associated with TBIs, but other symptoms, such as dizziness or blurred vision are subjective and difficult to disprove. In addition, TBI claims often include requests for life care plans to cover future care, which can increase litigation costs and settlement amounts.

Workplace violence

Any employer can face liability because of workplace violence, whether the event is caused by an employee or an outside party. Vicarious liability, negligent hiring, and premises liability are all ways businesses can put patrons, visitors, and others at risk. No matter the type or outcome of a violent incident, the cost to a business is high. In addition to covering large settlements or jury awards covering medical costs and punitive damages for injured parties, a company may also sustain costs related to lost productivity, safety and security upgrades, crisis communications, and more. There are, however, steps companies can take to reduce their risk.

Medical cost inflation

Medical inflation is a significant driver of loss severity, primarily because general liability claims are “long-tail” and medical treatments can last several years. The inflation rates for some medical related services continue to be higher than the “all-items” consumer price index (CPI). PwC’s Health Research Institute projects 2019’s medical cost trend to be 6% and says that efforts to reduce utilization have not produced the desired effect in lowering costs. Medical trends related to opioids and wellness are also driving liability claims severity.

Litigation funding

In recent years, litigation financing has become a popular practice in which third parties invest in lawsuits by covering legal fees in exchange for a portion of the proceeds of the lawsuit. The number of litigation funding providers could more than double this year from about 20 to 50 nationwide. Hedge funds also are getting into the game, with some creating in-house litigation investment departments. This practice increases the likelihood that claimants will go to trial, and that attorneys will pursue more complex arguments and higher settlement amounts.

Distracted driving

The omnipresence of mobile devices is contributing to higher accident frequency and increasing auto liability exposure for companies with fleets. As an example, if an employee is driving, gets distracted by a work-related text or email, and causes an accident, the employer can also be held responsible. Developing and enforcing policies on distracted driving and using personal vehicles are imperative to mitigate this risk.

Social responsibility

Gallup’s 2018 “Confidence in Institutions” survey showed that 30 percent of Americans have little or no confidence in “big business,” signifying a deep-seated mistrust that often sways juries to favor individual plaintiffs over corporate defendants. Juries now have a different sense of social responsibility, operating with a belief that deep-pocketed companies should go above and beyond and compensate “the little guy” for physical and non-physical damages.

Sharing economy

The sharing economy may offer an alternative to hiring employees, especially in a tightening labor market, but outsourcing tasks does not necessarily mean that associated liabilities are also outsourced. Distributors that hire rideshare drivers to make deliveries, for example, are still responsible for ensuring there is a qualified driver behind the wheel, even if it’s not a company vehicle or an employee. Companies may outsource work via sharing-economy relationships, but not all the related exposures.

Autonomous vehicles

The rise of self-driving cars has created gray area in the realm of auto liability. Previously, if two drivers were involved in a vehicle accident, one of them would typically be found at fault. However, in a semi-autonomous vehicle accident, the driver may not be solely to blame. Now, the auto manufacturer or even the software developer could also be held liable. This expanding liability creates potential for more complex and costly litigation and can also drive up the frequency and severity of claims.

Social media

More than once, an employee’s inappropriate or disparaging Tweet or Instagram post has resulted in their termination. While a business should institute social media policies to govern employees’ work-related usage, monitoring personal accounts for work-related complaints or asking for personal login information may overstep boundaries. A company could incur legal action and risk taking a reputational hit if it is perceived to be “spying” on employees or invading their privacy.

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.