The insurance industry continues to adapt and respond to trends affecting the marketplace. From new exposures like the effects of pandemics like COVID-19 to continuing challenges such as climate change and social inflation, learn more about how today’s risk factors are driving rate in a hardening market.

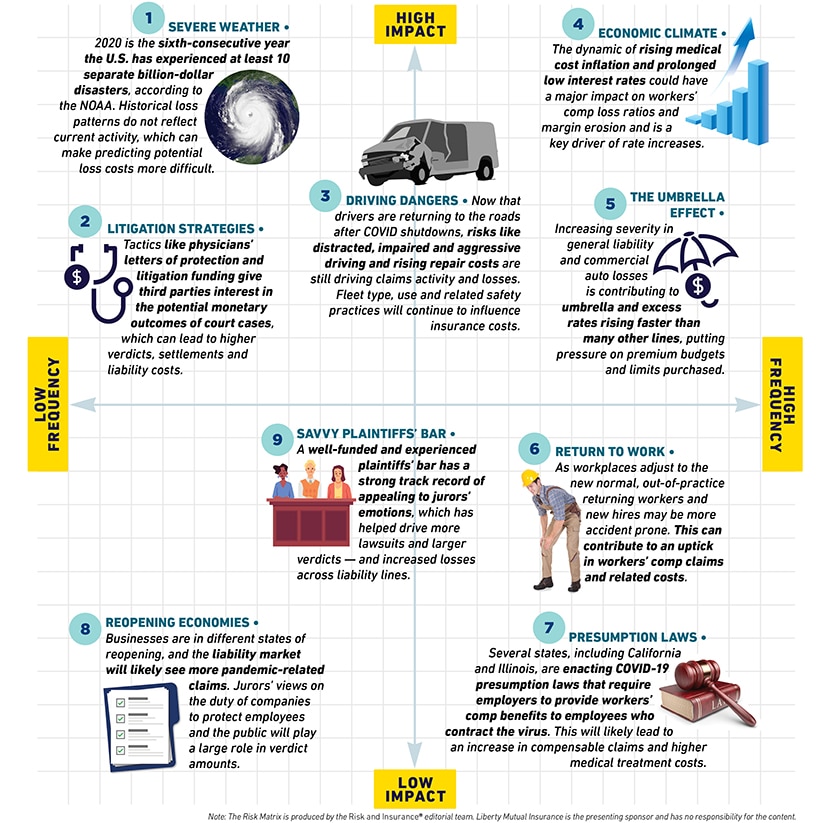

The hardening market risk matrix plots 9 trends that are driving rate increases throughout the industry.

The Risk Matrix, produced by the editorial team at Risk & Insurance®, plots ways today’s business trends are affecting rate within the insurance industry.

Severe weather

An above-normal 2020 Atlantic hurricane season has been predicted by the NOAA. But hurricanes are not the only threat. Drought, tornadoes and wildfires have all grown in size and scale in the last several years, alone. Historical patterns show that these devastating — and expensive — events are on the rise. In fact, the U.S. has already faced at least 10 weather and climate disasters this year, with losses exceeding $1 billion each. Conducting risk assessments to understand exposures and creating a business continuity plan can help your business mitigate risk and more quickly recover after severe weather hits.

Litigation strategies

The use of tactics like physicians’ letters of protection and litigation funding, in which third parties are invested in the monetary outcomes of court cases, is growing. Physicians’ letters of protection see plaintiffs’ lawyers entering into a fiduciary agreement with a physician that guarantees payment for medical expenses from the final settlement or verdict amount. Litigation funding is the practice of an unrelated party covering a plaintiff’s legal fees in exchange for a portion of the potential profits should they secure victory. These practices have given way to increased payouts for verdicts, higher settlements, and larger liability costs.

Driving dangers

At the onset of the COVID-19 shelter-in-place mandates, fewer drivers were on the road. But now that drivers are returning, the risks of a shortage of experienced drivers, distracted, impaired and aggressive driving, and rising repair costs are coming back in full force. According to a recent report by the National Highway Traffic Safety Administration, 2,841 people were killed and 400,000 people were injured in motor vehicle crashes involving distracted drivers in 2018. Implementing a fleet management program that prioritizes safety, leverages technology to monitor driving behavior, incorporates processes to identify root causes of poor driving, and delivers effective action plans to address problem areas can help mitigate driving-related risks.

Economic climate

Rising medical costs — as a result of factors such as medical inflation, more treatment options, and increasing prescription drug costs — are affecting workers compensation costs. For example, the new and increasing use of medical technology to treat injuries—including those suffered at work— can contribute 40% to 50% to costs. The dynamic of rising medical cost inflation and prolonged low interest rates could have a major impact on workers comp loss ratios and margin erosion and is a key driver of rate increases. To help curb the effect, partnering with a carrier that has a deep bench regarding both medical and workers compensation expertise can help ensure providers recommend appropriate care.

The umbrella effect

In today’s current climate, a variety of factors are helping increase severity in both general liability and commercial auto losses. For example, technology such semi-autonomous vehicles, 3D printing, and robotics are introducing new variables to the liability equation while also blurring the lines of responsibility. In addition, social inflation is helping to drive a costly rise in liability claims. As a result of these upward loss trends, umbrella rates are rising faster than many other lines, putting pressure on premium budgets and capacity limits.

Return to work

Another challenge in the wake of COVID-19 is the safety of returning, out-of-practice workers who may make mistakes as they readapt to their work environments, especially in higher-risk industries like construction or manufacturing. Additionally, new and untrained hires may also be more prone to accidents and injuries. With disabling workplace injuries costing businesses more than $59 billion annually, businesses should focus mitigation efforts on key areas of loss with their operations. Training employees on equipment and work processes will likely be critical to maintaining safety.

Presumption laws

California and Illinois have already enacted COVID-19 presumption laws that require employers to provide workers compensation (WC) benefits to employees who contract the virus, and several other states are considering doing the same. These regulations, which apply to different classes of workers depending on the state they are in, will likely result in an increase in compensable WC claims. To help mitigate this risk, companies are adapting workspaces to reflect social distancing guidelines, as well as providing training and adequate personal protective equipment to lessen the likelihood of spreading the virus.

Reopening economies

Businesses across America are in different stages of reopening post-COVID-19 shutdowns, and there’s an expectation that as we adjust to this ‘new normal,’ businesses have a duty to protect employees. With that expectation comes the potential rise in liability suits. Employers should prepare for potential employment claims that could rise out of the COVID-19 pandemic, including leave- and discrimination-related charges, breach of employment contract, WARN Act violations, and wage- and hour-related claims. Employers should review policies and procedures as they make important decisions surrounding employee safety.

Savvy plaintiff’s bar

Loss severity in general liability is being driven by social inflation — the theory that societal and legal factors promote more lawsuits, larger settlements and bigger class-action awards. This is due in part to a savvier plaintiffs’ bar equipped with the expertise and resources to appeal to jurors’ emotions. That kind of pull in a courtroom can sometimes sway the jury to set the facts of cases aside to do what they feel is right. This shift in jury mindset is a key driver of the nuclear verdict in today’s litigious climate.

Related insights

The Risk Matrix is featured with the permission of Risk & Insurance®. The Risk Matrix is produced by the Risk & Insurance editorial team.

This website is general in nature, and is provided as a courtesy to you. Information is accurate to the best of Liberty Mutual’s knowledge, but companies and individuals should not rely on it to prevent and mitigate all risks as an explanation of coverage or benefits under an insurance policy. Consult your professional advisor regarding your particular facts and circumstance. By citing external authorities or linking to other websites, Liberty Mutual is not endorsing them.